NEWSLETTERS

December 2020

Helping families, providers and facilities obtain medically necessary mental health and autism treatments through health insurance.

Reflections on 2020

Thanks to Heroic and Creative Providers and Facilities

CA Improved Parity Act: Next Stop, The Feds

Establishment of the Feda Fund

|

Donate Now to our General Fund

Thank You to All Who Have Given Generously

Support Our Mission Reflecting on 10 Years of Advocacy

- Failure to process an appeal within legal timelines and according to legal requirements resolves in favor of the appellant.

- If a health plan or insurance company denies a claim or appeal for a frivolous, unfounded, or illegal reason, the claim must be paid.

- When continuous care is denied or cut back, care should continue/be covered until the appeal is fully resolved.

- Deductibles and out of pocket maximums need to be brought down to reasonable amounts.

- We need a more transparent external review process, where reviewers follow national standards in making decisions, and are held accountable for their decisions.

- CA needs to update its mental health parity act to include substance abuse, reflect DSM V diagnoses, and require all medically necessary treatments for those with parity conditions (as has been determined by case law).

- We need restitution for consumers who have been unfairly treated by health plans and health insurance companies.

-

And finally, we need more treatment centers, providers, and ABA agencies that WANT to work with insurance, so that people can get the services they need without having to wait on long lists or take a second mortgage on their homes or spend down their retirement accounts. But health plans, we need YOU to make this happen, by making it easier on all of us to get the care to which we are legally entitled.

May you all have a thoughtful, joyous and healthy new year.

Thank you!

May you all have a thoughtful, joyous and healthy new year!

New MHAIP Website Understand the Affordable Care Act

- Insurance companies are prohibited from denying coverage or charging higher premiums due to preexisting conditions (including autism and mental illness.)

- Children covered until age 26

- Insurers must cover preventative care, including screening for autism at 18 and 24 months.

- Details on states the expanded Medicaid for families who earn less than 138% of federal poverty limit.

Thank you!

We so appreciate your support!

Whose Guidelines? A Landmark Case Against United Behavioral Health

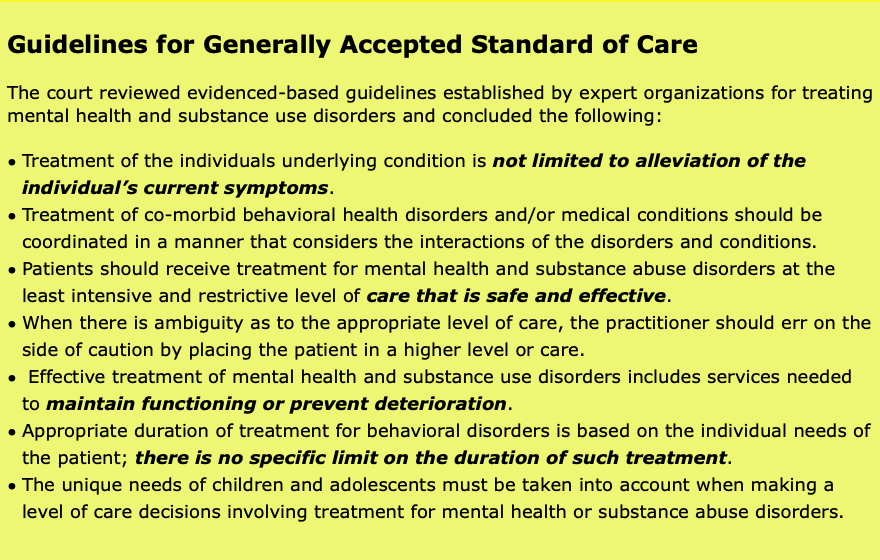

A federal court in Northern California ruled that United Behavioral Health (UBH) unlawfully denied the claims of some 50,000 patients who needed treatment for mental health and substance use disorder. The judge found that UBH used their own deeply flawed, internal guidelines as the basis for denying important treatment to patients. The plan's guidelines were created in part to deny more lengthy and expensive coverage for outpatient, intensive outpatient and residential treatment for mental health disorders.

A significant result of the court's ruling is the identification of evidence-based, "generally accepted standards of care". The guidelines are based on the research and guidance of clinical specialty organizations like the American Society of Addiction Medicine (ASAM) as well as the Level of Care Utilization System for Psychiatric and Addiction Services (LOCUS). The court established that health plans should not "create or buy" guidelines when there are already well-established clinical criteria from clinical specialty organizations. The internal UBH guidelines were, according to the judge, "unreasonable and an abuse of discretion."

For more details on the conclusions above, see sections 70.a. through 70.h. in the decision.

The full ruling can be read here.

The court found that UBH's medical-necessity guidelines inappropriately limited coverage based solely on acute symptoms. According to the judge, "UBH knowingly and purposefully drafted its Guidelines to limit coverage" and that effective treatment should include not just addressing current symptoms but also the underlying condition.

Significantly, the court noted that effective treatment of mental health and substance use disorders includes aiming to prevent relapse or deterioration and to maintain a patients level of functioning. UBH guidelines did not adhere to this standard because they required a finding that treatment should cause a patient to improve within "a reasonable amount of time", thereby reducing treatment to a reduction or control of acute symptoms only.

In addition to establishing clinical guidelines for treatment, the court found that UBH violated the federal Mental Health Addiction Equity Act, which requires large group health plans that offer mental health or substance abuse disorder to offer similar benefits to mental health and substance us disorder patients the same level of coverage that they do on medical/surgical benefits.

UBH used their in-house guidelines as a way to circumvent the requirements of the act to keep their costs down. The judge reminded UBH that chronic and co-morbid condition should be treated even when those conditions persist or need extended levels of care (much as a health plan would treat a patient with a chronic health condition like diabetes.)

What the Ruling Means for You

In advocating for appropriate treatment of mental health and substance use disorder, it’s essential to familiarize yourself with the generally accepted standards of care. Often guidelines developed by insurance companies are not in compliance with these standards. In fact, the judge found that UBH was not the only health plan to develop faulty guidelines in order to limit care.

In MHAIP’s work writing appeals for for people denied residential treatment, we frequently see reasons like, “You do not meet our standards of medically necessary treatment. You are not actively homicidal, suicidal, or currently hallucinating. Therefore, you do not need 24/7 care at a residential treatment center. Your care could be treated at the outpatient level.” This type of denial will no longer be acceptable and reviewers will need to look at the bigger picture, including providing enough time and treatment so that clients can address the underlying issue which contributed to the crisis and develop effective coping skills. Reviewers will also need to follow the standards established in this ruling that treatment should maintain the patients functioning going forward and prevent deterioration - not simply treat “acute symptoms the necessitated treatment to begin with."

Challenges In Getting Autism Services

The number of children diagnosed with Autism Spectrum Disorder has increased dramatically in the last two decades. Even when diagnosed at a young age, many families are confronted with lengthy wait times to access treatment like speech therapy, occupational therapy or behavioral interventions, or simply to get a formal diagnosis. Too often, parents are told by their health plan that they simply don't have the providers or agencies to treat their child with ASD. In some case, health plans flat out claim that they don't have providers in network as an excuse not to provide appropriate treatment. To counter these wait times it's important to know your rights and to have a strategy for dealing with time obstacles to your child's care.

Tips for getting care sooner:

- Keep track of the dates you made the request or received a referral for treatment. Most fully-funded health plan's are required to abide by certain timelines.

- Be Assertive - this includes calling frequently and asking about the status of your child's referral.

- Ask to be put on a cancellation list. For example, if you are waiting for an initial intake appointment (often the most time-consuming part of the process for providers), offer to be flexible about how much notice you need to come in for an appointment, if possible.

- Keep copies of all correspondence between you and your health plan.

- Write down all phone calls and dates. Request reference numbers for phone calls. Use your health plan's online chat feature and print out the transcript.

- Know your rights and file internal and external complaints (see below).

Know Your Rights

Timely Access to Care

Check your state health insurance regulator for guidelines they recommend for wait times for appointment availability. For example, in the state of California, the Department of Managed Health Care (DMHC) has developed standards for appointment availability for mental health and specialty care appointments. They stipulate that these types of appointments should be offered within 10 to 15 days. In addition, you should be able to locate these guidelines within your benefits documentation (often called Evidence of Coverage or EOC).

Network Insufficiency

In 2015, the Insurance Commissioner of California issued an emergency regulation that addressed the issue of insufficient providers limiting patient’s access to care. They require health plans to include an adequate number of providers in their network, including those who provide mental health and behavioral health care. Significantly, the Commissioner directed plans to “make arrangements to provide out-of-network care at in-network prices when there are insufficient in-network care providers.” If you live in California and have a fully-funded plan, you can either cite these guidelines in your internal complaint or file a complaint with the Department of Managed Health Care to get your health plan to offer an out-of-network provider to you.

TIP: If you do not live in California or your fully-funded plan is regulated in another state, find the state regulator at www.ncsl.org and and find out if your plan’s regulator has established guidelines when plan’s do not have sufficient in-network providers.

File a Complaint with Your Health Plan

Keep track of the amount of time that has elapsed from your request for autism treatment, or a physician’s referral for treatment, and the actual time you have had to wait. If it exceeds the plans guidelines, file an internal complaint with your health plan. If the plan told you they do not have enough providers, make note of that and the relevant state regulator’s requirements (as in the case of California)The internal process can take 30 days.

File a Complaint with the Plan's Regulator

If you are not offered timely treatment after the internal complaint process, you can file an external complaint with the regulator of your health plan. Your health plan should provide you with the information about how to file an external complaint. If they do not, you can locate this information by navigating to your state’s regulator.

Include in your external complaint the list of dates you contacted the plan, their response(s) and how long you have waited. Be sure to mention the reasons your health plan gave for delaying treatment, including whether they have sufficient in-network providers.

TIP: Check where your plan is located. In some cases your plan may be located in, and regulated by, a different state. Read through your coverage documentation for this information.

Cases We Have Won

Win in external review: After having been denied twice by BCBS of Texas, we won 6 ½ additional weeks of mental health residential treatment for an 18-year-old young Texas man diagnosed with schizoaffective disorder, bipolar type and a severe substance abuse disorder, in addition to trauma and developmental delays. MHAIP documented the 19 documented incidents of unsafe or aggressive behavior that met the criteria for mental health residential treatment to counter BCBS of Texas’ claim that the young man “could be treated safely and effectively in a less restrictive level of care such as Substance Abuse Partial Hospitalization/Day Treatment (PHP).” Because we won this in the external review process, it allowed us to then pursue residential treatment level of care for the final potion of this young man’s stay at a treatment center.

Win in external review: After months and months of stalling and delay tactics by Aetna and Beacon, we successfully won seven months of residential treatment level of care for an 18-year-old young woman from Kentucky diagnosed with oppositional/problematic behavior, mood and anxiety disorders, alcohol and substance abuse issues and trauma from sexual assault. Aetna and Beacon attempted to deny coverage for her stay at the residential treatment facility by claiming the provider was “not eligible to receive reimbursement” and that ““the member’s plan excludes this service” and then finally that the care was “not medically necessary.” MHAIP documented the 23 unsafe, inappropriate or aggressive incidents that met the criteria for mental health residential treatment as well as the slow progress she was making in the program, which convinced the external reviewer that the care was medically necessary. The external reviewer also affirmed that residential treatment was a covered benefit of the medical plan.

Overturn through Employer Involvement: MHAIP assisted the family of an 18 year-old young man from Wisconsin with attachment and self-harm issues obtain two months of residential mental health treatment. When the employer switched the plan to Anthem, they denied coverage. MHAIP wrote an appeal, but it was denied. We encouraged the family to take our appeal to the benefits manager at work. Says mom Paula

“A final tip I want to leave for other parents – read the ENTIRE insurance policy! I found a single sentence on page 105 of a 154 page document that states:

‘The employer can In certain circumstances, for purposes of overall cost savings or efficiency, in its discretion, offer Benefits for services that would otherwise not be Covered Health Services.’

We went to the Benefit Coordinator at my husband’s employer and she was a champion advocate for us! Thank you for helping us with this marathon! We learned that it up to us to demand services! We knew we had to fight for what was right and equitable even though the insurance companies made every step as inconvenient and prolonged as possible. MHAIP made all the difference in our attitude and our outcome!”

Win of an Out Of Network Exception on Appeal: Advised the father of an 18 year old girl from Maryland diagnosed with anxiety, depression, substance abuse and trauma disorders on how to negotiate an out-of-network exception with United Health Care to get his daughter's stay at a residential treatment center covered. United Health Care insurance company denied mental health residential treatment level of care twice, but when the United Health Care insurance representative read MHAIP's appeal about the girl's struggles and her need for residential treatment as well as the impact of the girl's behavior on her family, she agreed to approve an out of network exception.

Won 69 Days of of Coverage for Wilderness for CA Family: We won 69 days of coverage of a wilderness program in Utah for substance abuse for a 19 year old man from Alameda County, CA. Health Net initially failed to process the claims, then instructed us to obtain retroactive authorization, then would not allow us to retroactively authorize services, though instructions to do this were provided in the plan manual. We filed a written complaint to the plan, which they failed to respond to. When we followed up by phone, we learned that services were found to be medically necessary, but because they failed to pay the claims, we sought the assistance of the California Department of Insurance (CDI). After conducting a thorough investigation, CDI required that Health Net pay according to the terms of the contract.

Recovery of 87 Day Wilderness Stay: We recovered an 87 day stay in a Wilderness program in Idaho for the family of an Idaho teen suffering from depression and anxiety. The plan paid according to the terms of the contract after many phone calls and claim resubmissions.

Follow up to a win from the last newsletter: In our last newsletter, we reported winning over six months of residential therapy for a young woman from Colorado suffering from depression and eating disorders. We went back and successfully appealed a "timely filing" denial for the first six months of her stay. After many months of follow-up, we prevailed, as there was a clause in the contract that indicated if you were “legally incapacitated” the period for submission could be extended.

Win in Independent Medical Review: 15 hours of direct, weekly ABA treatment for a 16 year old male with ASD was denied by Anthem Blue Cross and reduced to 10 hours. The Department of Managed Health Care (DMHC) referred to the case for an Independent Medical Review (IMR). The reviewer found that 15 hours of direct, weekly ABA were medically necessary to treat the symptoms of his autism including adaptive skills, communication difficulties, safety awareness and executive function skills, among others. The review cited evidence-based guidelines developed by professional, clinical organizations.

Win in Independent Medical Review: Intensive outpatient treatment for a 3 year old child with oppositional behavior, aggression and anxiety was denied. Cigna Health denied both reimbursement for treatment beyond an initial 10 day authorization as well as denying prospective authorization for ongoing treatment. The California Department of Insurance (CDI) sent the case for an Independent Medical Review. The reviewer found that intensive outpatient treatment for a period of 6 months was medically necessary for the child, citing the Child and Adolescent Level of Care Utilization System (CALOCUS) guidelines developed by the American Academy of Child and Adolescent Psychiatry and the American Association of Community Psychiatrists.

Mhaip At Ed Rev Conference

Mhaip At Ed Rev Conference

On Saturday, May 4th, Dr. Fessel gave a presentation on "Navigating the Maze of Health Insurance for Mental Health Related Interventions."

Contribute To Mhaip: How Your Contribution Helps

1) Supplements our sliding scale program so that we can pay staff to assist more low-income families with writing appeal.

2) Return phone calls and e-mails, usually within a day. We answer your questions, and offer you advice on how to proceed.

3) Monitor legislation and inform policy makers on the needs of our special communities.

4) Work closely with regulators, bring systemic gaps, violations, and problems to their attention so that they can enforce the law when health plans fail to follow it.

5) Prepare and present trainings at local and regional conferences, to educate providers, facilities and families on how to work with insurance.

6) Keep you informed through our website, newsletter and user groups.

CONTRIBUTE HERE

Or

donate directly through our website.

OTHER WAYS TO SUPPORT MHAIP:

WISHING YOU A HAPPY SPRING!

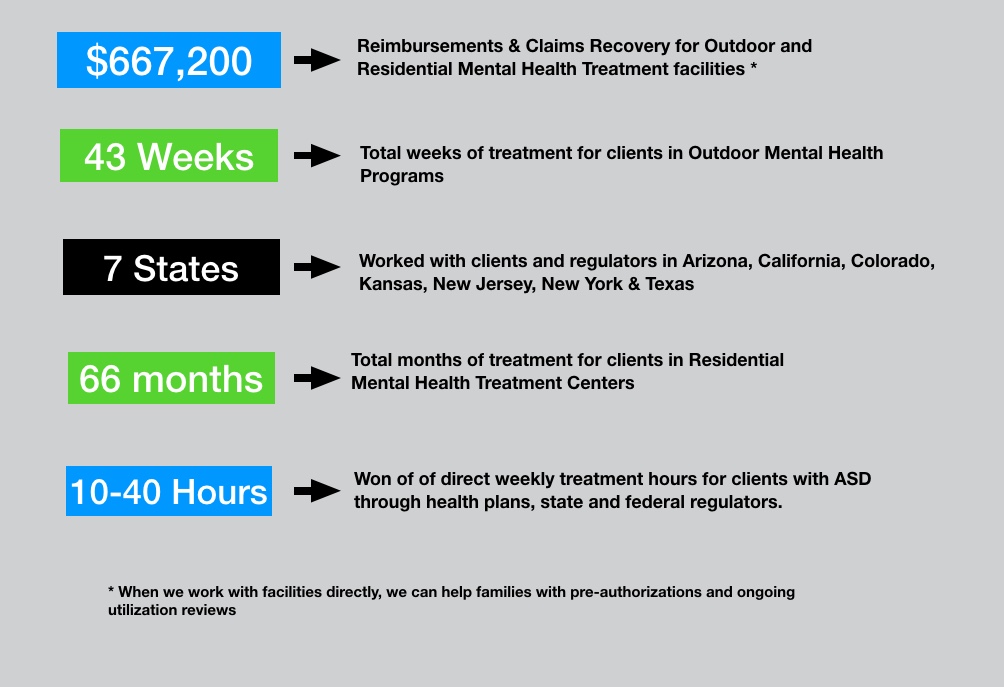

2018 END OF YEAR GIVING YOUR SUPPORT MAKES THESE SUCCESSES POSSIBLE!

Figures from last six-month period

PLEASE SEE "CASES WE HAVE WON" SECTION BELOW FOR FULL DETAILS

PLEASE DONATE

WAYS TO CONTRIBUTE

Or

donate directly through our website.

OTHER WAYS TO SUPPORT MHAIP:

CASE WE HAVE WON

Complete 12 Week Stay in Outdoor Mental Health Program

MHAIP recovered over $45,000 in payments for a twelve week stay in a hybrid Wilderness program for a 16 year old CA girl with depression, anxiety and eating disorders. We submitted claims to the plan, Blue Shield of CA. They repeatedly lost documents and told us incorrect information on the phone, which we documented with tracking numbers. We filed a formal grievance, which they failed to resolve or respond to. Later, we filed a formal complaint with the CA Department of Managed Health Care (DMHC). With the involvement of the DMHC, the plan ended up making an exception, and paid all claims in full

Recovered Over $325,000 for 15 families in one RTC

We recovered over $325,000 for 15 families in one residential facility over a six month period through the utilization review process. When we work with facilities, it is often more efficient than working with one family at a time, as we get to know the therapists, and they quickly learn the information we need to successfully work with the health plans. We also can reach out to families as soon as their children enter the program, which allows

First Six Months of One Year RTC Stay Overturned

MHAIP successfully recovered out-of-network benefits for six months from Premera Blue Cross for long-term residential treatment of a Colorado woman, who suffers from depression and eating disorders. We are currently working on recovering the second six-month period of her stay, despite the period being considered outside of “timely filing.” Because the client was legally incapacitated during her stay, the timely filing clock starts from the time discharge. It is looking good that this second period will be covered as well.

ABA Case Overturned by DMHC Legal

MHAIP appealed the denial of behavior therapy of a four year old Los Angeles boy with autism. Services were denied by Anthem after they were initially approved, because the provider was in-network with Anthem Medi-Cal, not Anthem commercial. We appealed, the denial was upheld by the plan. We filed a complaint with the CA state Department of Managed Health Care, and they ordered that the case be overturned, because Anthem violated CA law AB 1324, which requires that plans may not rescind payment after services have been authorized and rendered.

Overturn in External Review for RTC

We won an external medical necessity review to get mental health and substance abuse residential treatment covered for a young man from Texas. Despite the case being denied twice by the Blue Cross Blue Shield of Texas, we were able to document that the young man’s behaviors at the treatment center showed that he met the mental health residential treatment criteria for continued stay. The external review organization reversed the insurance company's decision, compelling the insurance company to cover his stay.

Recovered over 41K for 89 day stay in Outdoor Mental Health Program

MHAIP recently recovered over $41,000 for the family of a Kansas young man with anxiety and depression, who was treated in an outdoor mental health program for 89 days. Blue Cross Blue Shield repeatedly lost documents and failed to process claims. We requested that the employer step in and provide assistance, and after nearly a year of conversation, the plan paid.

Employer Intervened and Overturned United Denial for RTC

MHAIP appealed the denial of continued care for a 17 year-old youth with mood disorder, self-harm and severe substance abuse. He had been in residential treatment for two months, but was continuing to have multiple incidents and had not stabilized. After two months, care was dropped down to the partial hospital level of care. A few weeks later, United denied at the partial hospital level, as well. We appealed to both United and the employer, reviewing the client’s behaviors and arguing that he did in fact meet United’s criteria for continued stay at the residential level of care. The employer intervened and ordered United to cover an additional two months at the residential level of treatment.

Overturn from Beacon for Denying for Conflicting Reasons

MHAIP received an initial ten days of coverage for residential stay for an 18 year old man with severe anxiety and depression. After ten days, Beacon told that us that the client needed a higher level of treatment and future care would be denied. We requested reconsideration and a second Beacon psychiatrist determined that the client’s condition was not severe enough to justify further treatment, for the same timer period. We submitted an expedited appeal, alleging that Beacon was shopping for a denial. The appeal was partially overturned, and we will be submitting an additional appeal for additional days of coverage.

Federal Government ordered Overturn after Plan Retroactively Changed Terms of Coverage

MHAIP helped a six-year-old CA boy with autism receive coverage for his speech and occupational therapies for 17 months. His health insurance had been obtained through his mother's employer, a school district. When his insurance company, POMCO, retroactively changed his health plan to exclude autism services, MHAIP filed a successful appeal with the federal government, who ordered that the plan pay retroactively.

Assisted Parent in Writing Successful Appeal for Wilderness

We helped an Arizona-based parent of a 14 year old girl with severe depression, in writing her own appeal to BCBS for a denial for her daughter’s participation in a 49 day wilderness program. She successfully recovered out of network benefits for her daughter’s stay, which paid 50% of the total cost of the program.

State Regulator Ordered Plan to Cover Previously Approved RTC stay

MHAIP assisted the parents of a 15-year-old boy from New Jersey with Bipolar Disorder. His insurance plan, United, had refused to pay for his continued residential treatment on the grounds his care no longer was medically necessary, after having previously approved the treatment in utilization review. We filed an appeal with the New Jersey state regulators, and the insurance plan then agreed to pay for an additional six weeks of his residential treatment.

Complete Hybrid Wilderness Program Covered through Utilization Review

MHAIP won the complete 82 day stay from Cigna through ongoing utilization review for an 18 year old CA woman with anxiety and depression in a Hybrid Wilderness program.

Claims Recovery

We helped the family of a 16 year old boy recover over $40,000 and ongoing in claims from Blue Shield of CA, for six months in an RTC program.

HAPPY HOLIDAYS FROM OUR BOARD MEMBERS & STAFF

From left: Heather Morris, Laura Levandowski, Karen Fessel, Debra Nelson, Betsy Brazy, LaJoyce Porter, Feda Almaliti

NOVEMBER 2018 NEWSLETTER

WHO IS PROTECTING PREEXISTING CONDITIONS?

During the run up to the midterms elections, some politicians claim to support protections for preexisting conditions. It’s not a surprise as a majority of Americans support this provision of the Affordable Care Act (ACA). In a recent Kaiser Family Foundation poll, most respondents agreed that protecting people with preexisting conditions and guaranteeing coverage is “very important." (1) In fact, people planning to vote on November 6 report that health care is among their biggest concerns.

While paying lip service to protecting consumers, some elected officials currently running for office have been or are currently engaged in undermining the ACA in a way that directly weakens or eliminates protections for people with preexisting conditions. There are a number of efforts underway that include lawsuits to try to repeal parts of the ACA, offering so-called "lean" insurance plans and legislative proposals.

Lawsuits

One of the largest lawsuits against the ACA is currently being heard in Federal District Court for the Northern District of Texas. It was brought by a group of Republican state attorneys general and the governors of Maine and Mississippi. Their argument is that the law is unconstitutional and, because the provision requiring most people to have insurance was struck down in December 2017 (the individual mandate), the rest of the law must be repealed as well (2).

The US Department of Justice also weighed in to support the lawsuit and urged the court to strike down, specifically, consumer protections for preexisting conditions (3). The effect of any successful lawsuit would be mitigated by whether your state government would step in to offer protections for consumers. States like California and New York have a record of legislating consumer protections into state laws. However, other states like those whose Attorneys General are involved in a lawsuit against the ACA, have not adopted many consumer protections and people in those states are a risk of losing coverage for preexisting conditions if the lawsuit succeeds.

“Lean” and Short-term Insurance Plans

The Trump administration issued guidance that allows states to use ACA subsidies for plans that fail to protect people with preexisting conditions. The argument is that these plans are cheaper, but experts agree that they are poor-quality and do not comply with previous protections under the ACA. In addition, the Trump administration extended short-term insurance plans that were previously limited to 3 months and used as a stop-gap for people between jobs. Now, these so-called short-term plans can last up to 3 years. The plans are less expensive because they don’t cover pre-existing conditions. Even big, well-known insurers are participating in these flimsy offerings. UnitedHealth offers a low cost plan but, in the fine print of the plan, it notes frankly that “short-term health insurance is medically underwritten and does not cover pre-existing conditions.”(4)

Legislation

Earlier this year, the Trump Administration proposed a budget for fiscal year 2019 that includes eliminating the ACA’s Medicaid expansion which has been responsible for covering low-income adults. The idea is that the government would force states to come up with a way to cover some 12 million people who, without assistance, would have no health insurance. More shockingly, they proposed limiting the amount of federal funding for Medicaid for people with disabilities, seniors and children, regardless of need.

Finally, it is worth remembering the Republicans in Congress have spent years trying to repeal the health care bill, voting to undo provisions like coverage for pre-existing conditions over 50 times, most recently in 2017. Though no politician currently running for office would like you to do so, you can check on your local officials actual voting record on protecting consumer health plans that protect pre-existing conditions. Go to www.healthreformvotes.org to check. This non profit organization tracks voting records on healthcare issues nationwide. Select your state by clicking on it and navigate to either your Senator or Representative.

References

(1) Kaiser Health Tracking Poll - Late Summer 2018: The Election, Pre-Existing Conditions, and Surprises on Medical Bill. Ashley Kirzinger; Bryan We; and Mollyann Brodie (Sep 05, 2018).

(2) “A New Lawsuit Threatens Obamacare. Here’s What’s at Stake and What to Expect in Oral Arguments” The New York Times online. Goodnough,Abby’ Hoffman, Jan (Sept. 4, 2018).

(3) “Lawsuit Threatens Affordable Care Act Preexisting Condition Protections But Impact Will Depend on Where You Live” commonwealthfund.org. Corlette, Maasnasa; Giovannelli, Justin (Aug 29, 2018).

(4) “‘Short Term’ Health Insurance?’ Up to 3 years Under New Trump Policy." New York Times online. Pear, Robert (Aug. 1, 2018).

NEW MHAIP STAFF

MEET THE NEWEST MEMBERS OF OUR TEAM

Hilary Cox

Hilary assists families in appealing denied claims for medically necessary mental health treatment. Hilary’s background is in healthcare privacy compliance working for a wide variety of organizations such as a county health and hospital system, the federal government, a health insurer, and a law firm. She lives in the Bay Area with her husband, daughter, and dog-son. Hilary obtained her law degree from Stanford University and her Bachelors from UC Davis.

Sarah Jones

I started working young at the age of 15 in many different field ranging from Food Service, Customer Service, Administrative & Bookkeeping. It was just over two years ago shortly before I found out I was pregnant with my son Mason I wanted to get in the field of Medical Coding & Billing. As I continued my job as an administrator for New Leaf Community Markets during my pregnancy, I left for maternity leave and after a long leave I decided to put in my resignation to peruse being a full time mom & start my career. Shortly after my resignation, I enrolled in school to receive a Certified Medical Coding & Billing Certification. Days after enrolling I sent in my resume for a part time job in the field and was hired. I was beyond grateful & blessed with the amazing opportunity. The path I’ve chosen allows me to raise my son, participate in my online schooling & provide for my family. ______________________

CONTRIBUTE TO MHAIP

Or

donate directly through our website.

JULY 2018 NEWSLETTER

HOW DID WE GET HERE?

A PERSPECTIVE ON THERAPEUTIC RESIDENTIAL PLACEMENT

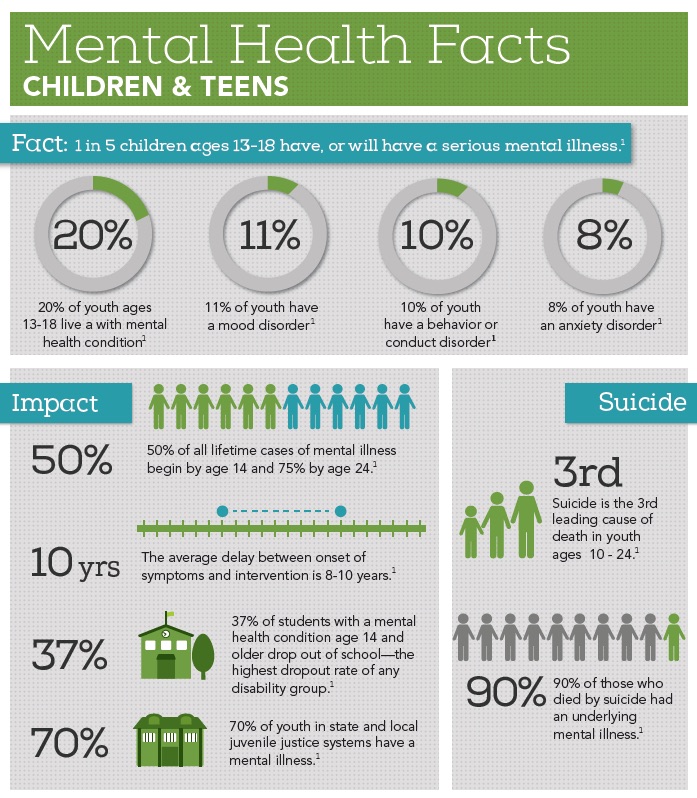

Parents’ dreams for their children seldom include placing them away from the family home before college or adulthood. Yet that is the complicated choice many parents face when their teenagers’ behavioral and mental health reaches a crisis point, whether due to an existing disability, or when a young person develops new struggles that put them at risk. The increasing number of young people with mental health challenges has been well documented. Nearly 1 in 5 young people aged 13-18 years experience a severe mental disorder at some point during their life. See the full infographic from National Alliance Mental Illness (NAMI) here.

Copyright National Alliance on Mental Illness

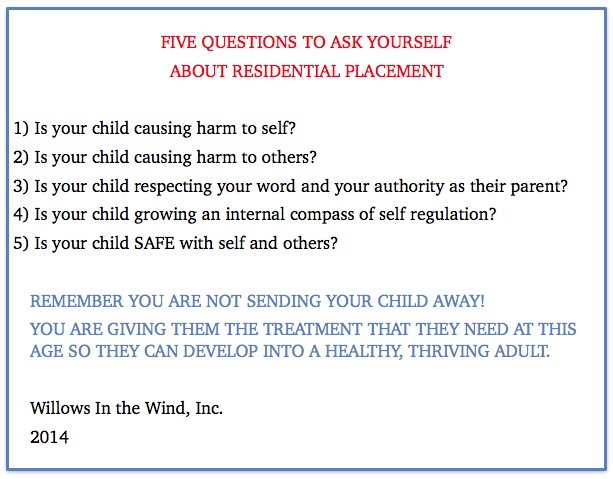

Not all teenagers and young adults with these challenges will need residential placement. If they haven’t responded to outpatient treatment, medication therapy or are at risk of harming themselves or others, placement outside the home may be warranted. Children with an existing disability, like Autism Spectrum Disorder, with an increase in self-injurious or other risky behavior that is not being effectively addressed in their school placement, may also need a more restrictive setting.

The benefits of residential placement include individualized treatment around the clock to address the challenges and behaviors that are putting them at risk as well as family training and support. Intensive intervention at this age will help children develop skills they can carry over into adulthood. You can learn more about these programs here.

The decision to place your child in a residential setting is complex and should involve professional guidance from a therapist or doctor who knows your child. However, we wanted to provide a perspective on how parents might arrive at such a decision. We reached out to Willows in the Wind, a San Francisco Bay Area non-profit, to gain their perspective into what questions should guide parents' thinking about this. This organization is a resource for families with young people either currently in residential programs, considering residential placement, or preparing for the transition back to the family home or community. They run monthly parent support groups in Los Altos Hills, San Rafael, Oakland, and Broomfield, CO, that offer practical advice as well as support from families who are in a similar situation. The Executive Director, Janet Rao provided us with the following set of questions parents should consider when contemplating a residential placement.

We recently spoke at two Willows events and educated their families on how to maximize the likelihood of getting insurance coverage for residential and after care treatments. Therapeutic residential placements can also by coordinated through your child’s school district. Often, placement through a district would benefit from the the insights and guidance of a professional Educational Therapeutic Consultant, according to Janet Rao. Lists of consultants can be found here and here. Speaking to other families who are in the same situation, or who have completed this sort of treatment, is also an invaluable source of information. You can contact them or learn more about Willows in the Wind here.

The Balanced Mind Parent Network is an online community that also offers support to parents seeking help for mental health challenges with their children. _____________________________

COMPLAINTS ABOUT ABA PROVIDERS

Our office has received an increasing number of phone calls recently from families with children with autism that have complaints about the quality of their ABA providers. While we care about our families and the quality of the health care that they receive, we typically get involved when there are disputes with your health plan about what is medically necessary, or when your health plan is not following consumer protections under the law.

First, try to address your concerns directly with the ABA provider by discussing in person or by phone. If this doesn't work, outline your complaint in writing. You should include specific examples of your complaint and any dates or times associated with the issue. For example, if a therapist consistently arrives late of fails to show up, document those incidences and include them in your letter. While some providers have their own toll-free complaint or customer service line, it is always a good to document your concerns in writing and then follow up with a phone call.

If you are unable to resolve the conflict with an ABA provider, it may be appropriate to contact the Behavior Analyst Certification Board (BACB). The BACB has a long list of appropriate behaviors that certified behavior analysts must abide by. According to their Ethics code, Behavior Analysts responsibility to clients include: operating in the best interest of their clients, providing effective treatment, and avoiding interruption of service, among other things. For more details, see Professional and Ethical Compliance Code for Behavior Analysts.

Instruction on how to file a violation with the BACB can be found here.

In addition to the BACB, other accrediting organizations may oversee your ABA provider and get involved when there are concerns with the quality of care. The Behavioral Health Center of Excellence (BHCOE), an agency which accredits ABA agencies which have demonstrated exceptional competence, will consider complaints for those providers that are accredited. Look at the BHCOE website to see if your provider is accredited with them.

In many states your ABA provider may be licensed with a state professional board. State boards are also responsible for fielding complaints and making sure that providers follow professional standards.

NEW MHAIP STAFF

Meet the newest members of the team

Allison Clark,

Patient Advocate

Heather Morris,

Advocate

Read their full bios on our About Us page _______________________

CASES WE HAVE WON

MHAIP Recovered over 10k for Ambulance Services for Client with Eating Disorder MHAIP was able to recover over $10,000 from Blue Shield of CA for a San Mateo teen girl with eating disorders who was transferred from an eating disorders program to a cardiac unit, after developing urgent cardiac problems. Blue Shield initially denied our appeal, stating that it was received after the deadline. It was actually delivered before the deadline, but Blue Shield took extra time to process. Regardless, the DMHC would not permit the denial due to timely filing and ordered Blue Shield to refund the payment to the family.

MHAIP Recovered over 93k for 11 Week Stabilization and Assessment

A 23 year old Alameda County, CA man with autism and severe depression requested stabilization and assessment with a residential facility in Utah through his HealthNet/MHN HMO. HealthNet/MHN was unable to provide a residential facility that could serve a young adult with a developmental disability in network. They denied the treatment because it was out of network. We appealed and took the case the CA Department of Managed Health Care. They agreed that an appropriate placement was not available in the network and ordered the plan to cover the treatment.

MHAIP Recovered over 47k for a 13 Week Wilderness Program

A 16 year old boy from Monroe County, NY with severe depression was denied treatment for his 13 week stay in a wilderness program in Wisconsin. Cigna alleged that treatment was not medically necessary, though he had been cutting, had had a prior suicide attempt, had ceased all activities, and was eating and sleeping irregularly just prior to going to wilderness. Cigna had failed to provide a plan manual, and had taken over 90 days to process the claims (federal standards allow only 30). Before going to external review, we reached out to the NY state attorney general’s office, who obtained the plan manual and provided a letter of support. The external reviewing agency agreed that services were necessary and the family was paid the full amount of the claim.

Residential Therapeutic Care Won through Ongoing Utilization Review

MHAIP conducts pre-authorizations and ongoing utilization reviews when clients contact us prior to starting residential treatment. Below are some of our highlights from this program:

We recently won 161 days of residential coverage (and ongoing) for a 12 year old girl from Colorado with bipolar disorder and severe anxiety from United Health Care.

From Sanford Health Plan, we obtained 98 days of RTC coverage for a 15 year-old girl with depression and anxiety from South Dakota.

We have won 284 days (and ongoing) residential for a 16 year-old California boy with autism, anxiety and severe depression from ComPsych.

We have won 65 days of residential (and ongoing) for a 17 year old Texas girl with United Health Care. We have won 41 days (and ongoing) for an 18 year old California woman from Cigna. We have won 33 days (and ongoing) for an 18 year old California man from Blue Shield of CA.

Autism Treatment Won by MHAIP through DMHC

MHAIP won additional hours of 1:1 ABA therapy and reimbursement for out-of-pocket payments for past ABA therapy hours for a family in San Mateo County, CA who have a six-year old boy severely affected with autism. Blue Shielf of CA (BSOC) cut back ABA hours from 30 to 25 hours a week after the family had filed a grievance requesting a 40 hour per week program. MHAIP appealed and showed the child experienced regression from the reduction in hours, DMHC agreed and required that BSOC pay for a 40 hour a week program.

MHAIP filed a successful expedited appeal with DMHC to reinstate authorized 40 hour per week of ABA therapy for an eleven-year old California girl with autism. The family’s health plan, a county health system through Medi-cal, had reduced ABA from the recommended 40 per week down to 10.

CONTRIBUTE TO MHAIP

Or

donate directly through our website.

APRIL 2018 NEWS

PROFILE: ATTORNEY GENERAL ERIC SCHNEIDERMAN OF NEW YORK

New York Attorney General Eric Schneiderman has been at the forefront of enforcing state and federal mental health parity laws and advocating for consumers seeking mental health and substance abuse treatment. The state of New York passed a mental health parity law in 2006, called "Timothy's Law," prior to the federal Mental Health Parity and Addiction Act, passed in 2008 by the Obama administration. These laws seek to ensure that mental health and addition are treated by health plans the same as physical illness. They require behavioral health coverage be no more restrictive than medical coverage in terms of financial requirements (co-pays, deductibles, etc.) or limitations on the number and frequency of visits to a provider.

While the new laws were welcomed by health care advocates and consumers, many health plans continued to deny or delay treatment for mental health and addiction. In this climate, Attorney General Schneiderman, who first assumed office in 2011, worked to enforce mental health parity laws and compel health insurance companies to provide coverage for consumers. His office provides a toll-free Health Care Bureau Helpline for consumers to learn about their rights, make a complaint about their insurer and get access to health care they are entitled to. The Bureau investigates insurers and providers, sometimes based on complaints from consumers, that ignore or fail to comply with the law. His office reached settlements, including levying hefty fines, with major insurers that failed to meet the behavioral health needs of their members.

We submitted the following questions to the Attorney General's office to gain insight into the approach his office has taken to help consumers, advocate for the law and hold insurance companies accountable.

Mental health and addiction recovery treatments must be regarded the same as other health insurance claims under the law. Attorney General Schneiderman has taken an aggressive approach to enforcing these laws and will continue to take on those who ignore the law, and by doing so, reinforce the false and painful stigma often associated with behavioral health conditions. The office is committed to enforcing New York State and federal mental health parity laws, which require health insurers to handle claims for mental health and addiction treatment services the same as medical claims.

Attorney General Schneiderman’s multi-pronged strategy to tackling New York’s evolving opioid epidemic includes enforcing mental health parity laws, obtaining settlements with major national and global health insurers to remove barriers to life-saving treatment for opioid use disorder, cracking down on drug trafficking rings, and urging health insurance companies to review their coverage and payment policies that contribute to the opioid epidemic.

To date, we have reached agreements with six health insurance companies in unprecedented enforcement effort of mental health parity laws – requiring the companies to implement sweeping reforms in their administration of behavioral health benefits, coverage of residential treatment for substance abuse, co-pays for outpatient treatment, and filing regular compliance reports with the Attorney General, among other reforms.

Through careful monitoring of our agreements, we have seen marked decreases in denials for mental health related coverage, including substance abuse. In some instances, denial rates shifted from a 50% to 11% for substance abuse treatment - this kind of change is dramatic.

We believe that by making examples of six plans, all plans are going to be much more careful in how they treat claims for mental health / substance abuse treatment

Our recent agreements with six insurance companies have ultimately provided over $2 million in restitution for members whose claims were improperly denied.

Having a consumer Helpline like the Health Care Bureau Helpline is key to providing a window into consumer complaints about health plan denials. Looking at patterns of consumer complaints will help to build a systemic case against a particular health plan. Establishing ties to providers is also a useful way to learn more about how providers and consumers are being treated by the health plans - and whether there might be something illegal/discriminatory going on.

Our Health Care Bureau safeguards the rights of health care consumers statewide through investigation of and enforcement actions against insurers, providers, drug companies, and other individuals and entities. The New York Attorney General’s Office hopes the Bureau’s work to enforce mental health parity laws can serve as a national model.

Advocates at MHAIP have reached out to Attorney General Schneiderman’s office in at least five cases with NY state enrollees, we have recovered all that we requested for four, and are waiting to hear back on a fifth case. We strongly encourage Attorneys General in other states to implement similar programs.

FIRST STEPS: GETTING ABA TREATMENT FOR YOUR CHILD

You can be your child’s advocate and secure ABA treatment through your health plan. Insurance coverage of autism treatment and services is required by law in 46 states and the District of Columbia, including ABA. To secure this medically-necessary treatment for your child, follow the steps below:

Determine if your plan is regulated by the state, referred to as fully-funded, or subject to federal regulation, a self-funded plan. If you are uncertain about whether you have a state regulated plan, check with your human resources department or the administrator of the plan.

Fully Funded: The laws vary slightly from state to state but if your plan is regulated by your state, there is an appeals process and other supports in place that ensure that plans meet their obligations under the law.

Self-Funded: These plans are exempt from state regulation. While there are fewer protections for consumers, many self-funded plans do cover autism treatments like ABA. Read through your Plan Description or contact the insurer to determine whether autism treatment is covered.

If your plan doesn’t explicitly exclude autism treatment, it is worth going through the authorization process (see the following section) to determine whether you can get coverage.

A list of states that require insurance coverage of autism services can be found at www.ncsl.org.

Locate your state’s mandate and bookmark the website for future reference. This information will also be useful if you need to file an appeal with the state regulator if your child is denied treatment.

Check where you plan is located. In some cases, your plan may be located in, and regulated by, another state from the one you live in. Read through your evidence of coverage for this information. You will need this information to file for an appeal against a decision to deny autism treatment.

If your child has an assessment confirming a formal diagnosis of an autism related disorder, in most health plans, you can contact your health plan directly and request services. Some plans may have a a separate carve-out for behavioral health treatment. If your insurance has a separate division for behavioral health, you may need to make a request for services through this entity. The phone number should be on the back of your insurance card. Call them to request authorization for services. When asking for treatment, tell them you have a child with ASD and ask for a provider or list of providers experienced with treating autism.

If autism is suspected but your child has not had a formal assessment, you’ll want to call the same number on the card to request an assessment. In some health plans, you may need to get a referral from your child’s pediatrician.

TIP: Document all your correspondence with your child’s doctor and the health plan. For example, note the date and time and what was discussed - asking for a phone call log number if applicable. If you write an email or letter, keep copies for future reference.

Options if you can’t get an authorization:

If, for some reason, you cannot get an authorization, ask to speak to a supervisor or a manager in that division. If they tell you they can’t authorize treatment, ask them why and what steps you need to take to get treatment authorized. Request a written denial letter, - in some states this can be useful in getting services from other entities (Medicaid, Departments of Disabilities, Regional Centers, etc).

They are usually required to respond to your request for authorization in less than 30 days, so take note of the date of your request and follow up with your health plan if you haven’t received a response.

TIP: If asking for authorization over the phone, write an email or letter summarizing the conversation as well as the date, time and representative you spoke to, through your health plan’s electronic system.

What to do if No Providers Are Available:

This is becoming an increasingly common problem, as there are more people that need services than there are qualified providers to serve them. The steps involved in exploring the plan network and requesting a single case agreement can be found here (scroll down to Network Insufficiency), which is useful if you know someone outside of the network that can serve your child. Increasingly, however, we get calls from families who are facing full networks and no place to go. When this happens, we encourage you to write up a letter explaining the situation, and file it with both your health plan and the state regulator. Information can be found here (scroll down to “No Available Providers.”) A sample letter can be found here.

Despite the fact that ABA treatment is widely recognized as an evidence-based treatment for ASD, insurers may nevertheless try to deny coverage or cut back hours. In state-regulated plans especially, you have the law on your side. Even if you have a self-funded plan, you have appeal rights and it’s worth pursuing an appeal to secure ABA.

Submit an Appeal to Your Health Plan -

In some situations, you must first file an appeal with your health insurer, wait 30 days, and then involve your state’s health insurance regulator. If your child’s behaviors are rapidly deteriorating, you may be able to request an expedited appeal. More information on requesting expedited status for Californians can be found here (scroll down to “Requesting Expedited Status"). Your insurer must give you written notice of denial of coverage. The denial should include the basis on which they are denying treatment. Further, the denial letter should include what steps you can take to appeal the decision. If this information is not included, you can determine the appeals procedure by looking at your benefits handbook or contact the Member Services department and ask them what steps you can take to appeal the decision.

Write an appeal letter by referencing, and including, all supporting documentation that will help your child’s case:

*Evaluation or assessment diagnosing ASD

*Assessment from a treatment provider (psychologist, behavioral specialist, primary doctor)

*Letter from a provider outlining why ABA is medically necessary for your child.

If the denial alleges that care is not medically necessary, the plan must tell you why. Where necessary, correct the insurer’s information and back it up with information from the assessments.

Mail your appeal letter and all supporting document to your health plan via registered mail to document that you sent, and the plan received, the appeal. If you FAX the appeal, print the confirmation sheet. Your insurer usually has 30 days to respond to your appeal so follow up with them if you don’t hear anything after that time.

TIP: Even if you are first required to go through the health plan’s appeal process, you can contact your state’s regulator for help and advice on your case prior to filing an appeal with the regulator.

If you have a fully-funded plan, identify the regulator for your state (www.ncsl.org) and look up the information for filing an appeal or a grievance against your health plan. In some states, you don’t have to wait for your health plan to respond to your appeal before involving the regulator. Call and ask what the specific policy is for your state.

The regulator will review your child’s case and all documents relating to the denial (assessments, referrals, denial letter, explanation of benefits, etc.) They will try to resolve the case with your health plan on your behalf.

In some cases, your child’s grievance may be eligible for an Independent Medical Review (IMR). An IMR is conducted by a physician or relevant specialist who is not affiliated with your insurer. They will review the case and decide if the health plan’s denial of treatment was appropriate and whether coverage should be provided.

CASE WE HAVE WON

Pre-authorizations: MHAIP does pre-authorizations for families that contact us before their children start residential treatment or very early in their stays. Success rates are typically higher than when we go in after the fact. We recently won the following, all from United Health Care, at the residential level of care: 51 days of coverage for a 12 year old girl from Colorado with bipolar disorder and severe anxiety; 40 days of coverage for a 16 year-old boy from Tennessee with severe depression; 33 days of coverage for a 15 year old boy from Texas with mood dysregulation disorder and substance abuse. From Sanford Health Plan, we obtained 52 days of RTC coverage (and ongoing) for a 15 year-old girl with depression and anxiety and 22 days (and ongoing) for a 17 year old boy with severe depression, substance abuse, and oppositional disorder, both from South Dakota. We have won 188 days (and ongoing) residential for a 16 year-old California boy with autism, anxiety and severe depression from ComPsych.

Some plans allow requests after-the-fact. We obtained 102 days of residential coverage (and ongoing). in a retro-authorization from Care First for a 16 year-old girl with major depression and substance abuse from Maryland.

MHAIP recovered over 36K from Horizon Blue Cross Blue Shield for a seven week stay at a Wilderness program for an 18 year-old New Jersey youth with depression and substance abuse issues. Horizon had initially denied treatment, alleging that care was not medically necessary. We appealed, they upheld their denial. We then took the case to the New Jersey Department of Banking and Insurance, they agreed with us and ordered the plan to pay.

MHAIP helped a young man from New York with substance addictions get coverage for an additional 51 days of mental health residential treatment.

In our last newsletter, we reported that MHAIP had helped a 22-year-old man with depression and substance addictions obtain coverage for 50 days of residential mental health treatment. MHAIP had filed a successful complaint with the New York Attorney General, arguing that Beacon had unlawfully denied coverage for the type of care he received. Beacon then agreed to pay for the first 50 days of his care. Beacon, however, denied the remaining 51 days of his treatment, alleging it was “not medically necessary”. MHAIP then filed a successful appeal with the New York Department of Financial Services, and Beacon was required to pay for the remaining 51 days of his treatment. In total, we helped to recover over $89K, nearly 7K of which was interest.

MHAIP helped a family partially overturn a reduction of ABA hours. We assisted the family of a 15 year-old California boy to appeal the plan’s abrupt reduction of ABA therapy from 36 to 15 hours weekly. The basis of the insurer’s denial was that the number of goals did not support the need for the number of hours requested. After we filed an appeal, the plan overturned their decision and authorized 20 hours of ABA therapy weekly, including 2 hours of oversight and protocol modification. The young man receives therapy at home and in a mainstream classroom setting. MHAIP is currently helping the family with a secondary level appeal.

MHAIP wins Second Hour of Weekly Speech Therapy for 7 year old to learn AAC Device

A seven- year-old non-verbal boy with autism from Santa Clara County was repeatedly denied a second one-hour speech therapy session per week by Kaiser to support his use of an assisted adaptive communication device (AAC). Kaiser based their denial on the assertion that “there is no current medical evidence that shows an increase in the frequency of speech therapy will lead to an increased rate of development in speech and language skills.” MHAIP appealed to the DMHC and the DMHC agreed; the DMHC compelled Kaiser to provide an additional one-hour of speech therapy per week because a “children with autism benefit with improved receptive language skills with the use of an AAC device.”

CONTRIBUTE TO MHAIP

Or

donate directly through our website.

WEB RESOURCES

Hear our recent live podcast interview on Parents Journey, "Wilderness and Residential Treatment, Working with Insurance." Parents Journey was founded last year by Andy and Laurie Goldstrom, in order to share advice and challenges that they went through in their daughter's journey with mental health issues.

"Allowed Amount" or “Usual and Customary” information

The Fair Health Medical Cost Lookup offers information on estimated costs for healthcare professionals’ services.

Requires health insurance providers to provide coverage for behavioral health, including autism spectrum disorders.

MHPAEA requires that the financial requirements (such as coinsurance) and treatment limitations (such as visit limits) imposed on mental health and substance use disorder benefits cannot be more restrictive than the predominant financial requirements and treatment limitations that apply to substantially all medical/surgical benefits.

This CA act requires that the services provided by health care service plans be available to enrollees at reasonable times and makes a violation of its provisions a crime.

Allows you to file complaints against employer-funded ERISA health plans.

2015 Plans must make arrangements to provide out-of-network care at in network prices when there are insufficient in-network care providers

2013 Plans may not deny ABA therapy based on it being "experimental." They may not require cognitive testing, and they may not require a state licensure if the provider is a BCBA.

stating insurers must continue to provide existing coverage of treatment until an appeal is resolved.

Section 147.136 F (2) (iii) Requirement to provide continued coverage pending the outcome of an appeal. A plan and issuer subject to the requirements of this paragraph (b)(2) are required to provide continued coverage pending the outcome of an appeal. For this purpose, the plan and issuer must comply with the requirements of 29 CFR 2560.503-1(f)(2)(ii), which generally provides that benefits for an ongoing course of treatment cannot be reduced or terminated without providing advance notice and an opportunity for advance review.

FREQUENTLY ASKED QUESTIONS:AUTISM BENEFITS

HOW DO WE GET AN AUTISM ASSESSMENT OR AUTISM SERVICES (SPEECH, OT, ABA) FOR MY CHILD THROUGH INSURANCE?

If you are in Medicaid Managed Care or an HMOs (including Kaiser), follow the steps below:

- WHAT DO I DO IF I THINK MY CHILD MAY HAVE AUTISM?

If you think your child may have autism, see your pediatrician, explain the symptoms, and request that your doctor screen for autism. If the doctor agrees that your child may have autism, request an assessment.

- HOW DO I GET SERVICES IF MY CHILD ALREADY HAS AN AUTISM DIAGNOSIS?

If your child already has an autism diagnosis, share the report with your child’s pediatrician and ask him or her to request assessments for the services that were recommended in the diagnostic report (usually speech, occupational and ABA therapies).

- WHAT DO I DO IF MY DOCTOR DOES NOT KNOW HOW OR WHERE TO REFER MY CHILD, EITHER FOR ASSESSMENT OR TREATMENT?

If the doctor does not know how or where to refer your child, either for the assessment or for autism treatment (ABA, Speech and OT), call the health plan (the number is on your card) and ask how to proceed. Some plans allow you to call their experts directly and will give you the numbers, and some plans will require you to go through your doctor. Increasingly, lists are available online. Write down the date and time of the call, the name of whom you spoke with, and request a tracking number. Write down names of providers, call them, verify that they take your insurance, and set up an appointment.

WHAT DO I DO IF I AM IN A PPO?

- If you are in a PPO follow the steps above, as it is much less costly if you use in-network providers. If you go out of network, know that you will have to lay out the costs up front. The plans will pay at a rate that they determine is usual and customary (it is often neither), and after that, the plans will pay the pre-agreed upon percentage (50-80%, usually).

- You want to check to see if there is a network of providers in your plan. If there is not, or you cannot find the list of providers online, call the number on the card and request a list of autism experts. Document the call.

FOR PPO, HMO AND MEDICAID CLIENTS: WHAT DO I DO IF THERE ARE NO PROVIDERS IN THE NETWORK THAT CAN SEE MY CHILD, OR MY CHILD GETS PUT ON A LONG WAIT LIST?

- The plans are supposed to get you in within 10 business days for mental health, and 15 business days for other conditions (for CA). If they do not have an adequate network, write a letter to the health plan and document what you have done to try to secure treatment. Send it by priority mail and save the receipt. Make a copy of the letter.

- WHAT IF THEY DON’T RESPOND OR I STILL CAN’T GET TREATMENT OR AN ASSESSMENT?

After 30 days since submitting your complaint, gather all the documents and write a complaint to your state's Department of Insurance, Consumer Complaint division. Mental Health and Autism Insurance Project, or your local Family Resource Center can provide advice along the way.

WHAT IS A SELF-INSURED PLAN AND HOW DO I GET COVERAGE IF MY PLAN IS SELF-INSURED?

A self-insured plan is typically provided by very large companies. They actually pay the claims, and they pay a company like Anthem or United to administer it. With respect to autism treatments, they get to choose which benefits they cover and which ones they do not cover. They also can put limits on things like speech and occupational therapy. They can choose to cover ABA or not to cover ABA, though attorney are investigating whether this is legal.

- HOW DO I FIND OUT IF MY PLAN IS SELF-INSURED OR FULLY FUNDED?

Call the number on the card and ask.

- HOW DO I KNOW IF THE AUTISM ASSESSMENT AND BENEFITS ARE COVERED?

Get a copy of the plan manual, either from the insurance website or the employer website. Look up the benefits that your child needs, and see if it is covered. Also, call the number on the card, tell them that your child needs autism treatment or an autism assessment, and ask them what is covered.

- WHAT DO I DO IF MOST OF THE AUTISM TREATMENTS MY CHILD NEEDS ARE NOT COVERED?

Get a letter from your child’s employer stating that the autism related services are not covered. If your child meets eligibility for regional center (in California) and is a client, request the Medicaid waiver from the caseworker, and follow the process described above. In other states, apply for the Medicaid waiver, more states are now offering intensive behavior services through Medicaid.

- WHAT DO I DO IF MY CHILD DOES NOT MEET REGIONAL CENTER ELIGIBILITY OR THE MEDICAID WAIVER?

If you can afford it and you live in a state that offers the benefit in your exchange, purchase a child only plan. Child only plans range from $150-$400 per month. We recommend a Platinum level plan because the out of pocket annual costs are less. With a treatment like ABA, you will likely hit this in a few short months. The exchange is usually open November 1 – January 15. If you have FFS Medi-Cal (CA only, not in a managed care plan) and want to stay with that, contact your local regional center. They are obliged to provide ABA services to those with FFS medi-cal if your child meets regional center eligibility.

ARE INSURERS ALLOWED TO IMPOSE VISIT LIMITS ON ABA THERAPY, SPEECH THERAPY AND OT?

The short answer is no. The long answer is it depends upon what type of insurance you have.

Medicaid: If you are on public benefit insurance, Medicaid may not place visit limits on any speech, OT, or ABA for children under 22 years old. This falls under a federal statute called EPSDT, or Early Periodic Screening Diagnosis & Treatment. Managed care plans may try to impose visit limits, but they are not legally allowed to so and this can be successfully appealed to the insurance regulatory body in your state.

State-regulated or Affordable Care Act Plans: These plans are required to abide by any state mental health parity acts, as well as the Federal Mental Health Parity Act. Under parity, health plans may not put treatment limitations on ABA or any other mental health treatment unless they put treatment limits on medical treatments, for example, the number of chemo sessions they will allow (which they don't do!). If for some reason your plan has quantitative treatment limits on medical treatments (which is highly unlikely) than they may also limit mental health treatments (including ABA). This is most likely not the case. This issue has been tested and successfully won in court in A.F. v. Providence Health Plan. Every state has a state department of insurance that regulates fully-funded insurance plans. If your state-regulated or ACA plan is not complying with state and federal parity acts, you should file a complaint with your state department of insurance or CONTACT US for help.

Self-Funded/ERISA Plans: Self-funded plans are beholden to the Federal Mental Health Parity Act but not state parity laws. While the FMHPA should be enough, it comes down to a matter of enforcement. While fully-funded and ACA plans are enforced by state departments of insurance, self-funded plans are regulated by the Department of Labor. To date, we have not found this department particularly helpful in enforcing violations, although the Obama administration has indicated that this is a priority. Probably the best strategy if your self-insured plan is out of compliance with parity laws is to approach the HR person at your company and explain to them how the health plan is in violation. Employer-funded health plans are paid for by your company. They have the ability to instruct the health plan to change course if they wish.

WE LIVE IN CALIFORNIA AND HAVE BEEN RECEIVING ABA SERVICES THROUGH THE REGIONAL CENTER. WE WERE RECENTLY TOLD THAT WE NEED TO SWITCH TO MEDI-CAL SOON TO RECEIVE OUR ABA SERVICES. WE DO NOT HAVE MANAGED CARE MEDI-CAL, RATHER A WAIVER VIA INSTITUTIONAL DEEMING. HOW CAN WE CONTINUE TO RECEIVE ABA THERAPY?

Those that are not in a managed care plan will continue to get their ABA through Regional Center. If you are nervous about this and would like reassurance from the state, please explain your situation and to abainfo@dhcs.ca.gov. If Regional Center tells you that they cannot cover you, please ask them to put this information in writing. Some families have chosen to switch to a managed care Medi-Cal plan.

I HAVE A PREFERRED PROVIDER THAT I WOULD LIKE TO USE FOR ABA/SPEECH/OT BUT THEY DO NOT ACCEPT INSURANCE. WHAT CAN I DO?

Call your insurer and tell them your primary care physician has recommended ABA/Speech/OT and who do they have in-network to provide such care? Obtain a tracking number to document this call. Then call up to five of the people they recommend and see if any have current availability. If they do not, call the insurer back and tell them that you tried, and you'll need a gap exception where they pay at the in-network rate as their network is inadequate. If the insurer does have providers and you are in a PPO plan, send in all claims and you should recover some of what you have paid out. If you don't feel that the providers they offer have the expertise to meet your child's particular needs, you can make a medical necessity argument as to why what they offer is not meeting your child’s needs.

I AM IN THE UNITED STATES ON A TEMPORARY VISA. CAN MY CHILD WITH AUTISM RECEIVE MEDICAID?

Yes! If you otherwise qualify financially, being a temporary resident is not a reason that you should be denied Medicaid. If your local county office tries to deny you, ask to speak with a supervisor. If the problem persists, please contact us to help you.

I AM A CALIFORNIA RESIDENT AND HAVE REQUESTED ABA THERAPY FROM MY MEDI-CAL MANAGED CARE PLAN FOR MY CHILD WITH AUTISM. THEY HAVE GIVEN ME A LIST OF PROVIDERS, BUT ALL THE PROVIDERS HAVE SIX MONTH OR LONGER WAIT LISTS. WHAT CAN I DO?

Under the law, you are entitled to timely access to care. Six months is too long to wait. Please use this sample letter, customize it to your Medi-Cal managed care plan and situation, and file a grievance with the health plan and the Department of Managed Health Care.

If your question is not answered on this page, please feel free to email us.

MY EMPLOYER PLAN DOES NOT OFFER ABA, SPEECH OR OT. WHAT ARE MY OPTIONS?

If you live in a state that offers autism benefits through the exchange and can afford it, buy an Affordable Care Act plan. These plans are required by law to cover ABA, ST, OT and PT for those with ASDs, so long as it is medically necessary.

May 2021 Newsletter

Listen to a podcast with our own Karen Fessel, MHAIP Executive Director, as a member of the panel.

Podcast: American Health Law Association's Behavioral Health Task Force: Payment Parity for Behavioral Health, Part 2: Perspectives from a Payer, Provider, and Parent Advocate

Gregory Moore of Dickinson Wright PLLC, moderates a discusssion with Deepti Loharikar, Association for Behavioral Health and Wellness, Karen Fessel, Mental Health and Autism Insurance Project, and Alec Green and David Green, Sanford House, about behavioral health payment parity and other issues from the payer, provider, and parent advocate perspectives. Listen to this lively discussion here.

Hear our recent live podcast interview on Parents Journey, "Wilderness and Residential Treatment, Working with Insurance." Parents Journey was founded last year by Andy and Laurie Goldstrom, in order to share advice and challenges that they went through in their daughter's journey with mental health issues.